- #Free financial software to get out of debt how to#

- #Free financial software to get out of debt professional#

Also, get quotes for your insurance on both your house and your car each time a renewal comes up. The first thing is to try to renegotiate. Every step you make towards getting out of debt means you are closer to having your money work for you.Īlthough you can not really control your housing and transportation costs on a day to day basis, you still need to take a hard look at your housing and transportation to see if you can cut costs. Every time you make a sacrifice and stay on budget you will be investing in your future.

The good news is that it will be worth it. But it will take sacrifice to get out of debt. Then you will need to do something even more difficult, SACRIFICE. The only way to be sure you know what you spend is to record everything. This sounds simple, but to control your expenses you first must understand what they are. You must also learn to control your expenses.Įliminate Debt by Controlling Expenses - Budget This is perhaps the toughest but most important part of getting out of debt.Įasy right? I agree that this is much easier said than done.

Pay these bills off and then pay off your credit card every month and you will start saving money immediately in all the interest you will save. But credit card debt is usually very expensive. Pay off your credit card - Ugh! This is a tough one.

They will know if this step is something you should consider. But be sure to check with a financial advisor. If you've reached the point where you simply can't pay your bills, it is an option. This first step is really only for people who are in serious debt and have no other options. If this doesn't work, then look into debt consolidation. Try to get your debtor to agree to a lower payout and a lower interest rate. I suggest that you first renegotiate your debt. They will be a temptation and you could end up further in debt than you were before debt consolidation. If you do consolidate your debt, you should cut up your credit cards. DANGER! DANGER! There is a real danger with debt consolidation in that you will then have payed off credit cards. This is where you basically take out a lower interest loan and use it to pay off all your higher interest loans like credit cards. You can also consolidate your debt through debt consolidation. Don't be afraid to explain your money and credit situation. Either way you both you and your lender can come out better with a proper negotiation. Even if they won't take a lower payback, they may often allow you a lower interest rate. You can often get them to take only 60 to 70 percent of the original loan.

#Free financial software to get out of debt professional#

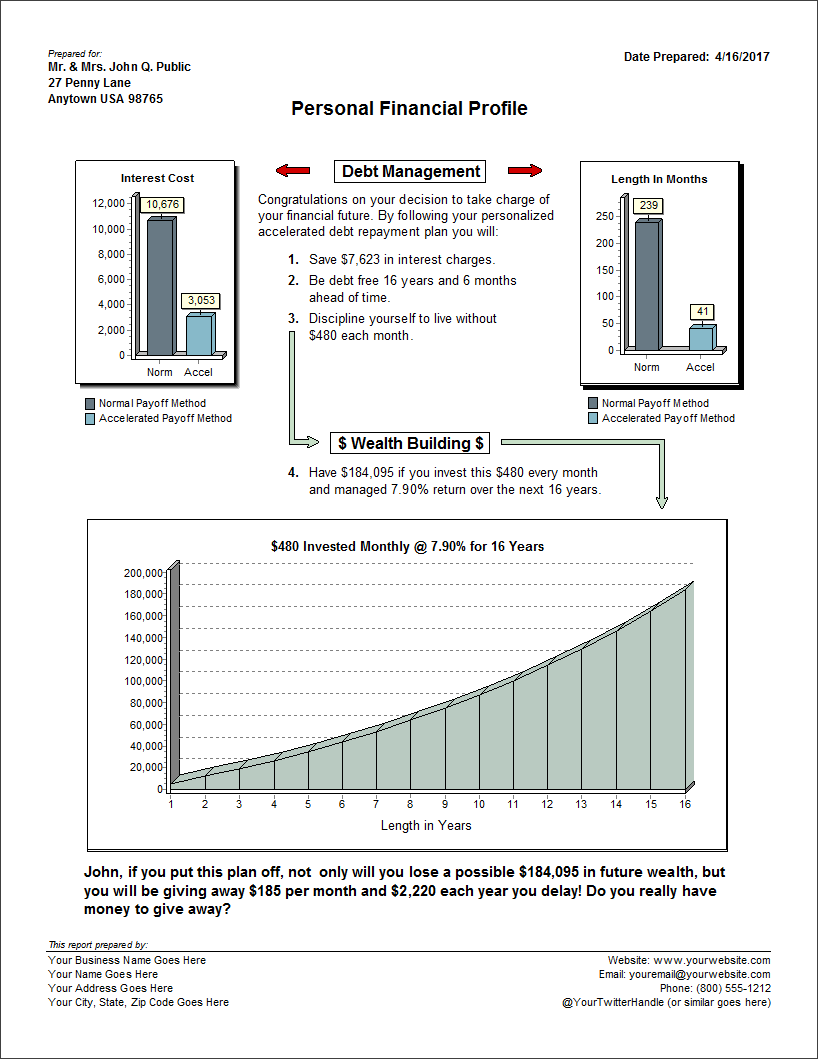

In debt negotiation or debt settlement you, or a professional debt negotiator, work out a new debt amount. Many companies are concerned that they will never get you pay off your debt, so they will be happy to extend you better terms (called debt negotiation) or even to take a reduced amount (debt settlement) just to be sure they get some of their money back. This will allow you to pay off your debt faster. The first thing you need to do is get your debt as low as possible. Renegotiate debt, consolidate debt, and settle debt.

#Free financial software to get out of debt how to#

See the Controlling Expenses section on some ideas on how to help with step 2. The most difficult step by far for most people is step 2, which is paying off credit cards. This is because as you complete each step you will have additional income available for the next step. It helps if you complete or examine each step before you move on to the next. We've put together five steps to getting out of debt and back on your feet. On this web site we will show you a slow, but hopefully helpful way to get out of debt for good. Now, this is not a popular, easy, or fun sounding method of reducing and eliminating debt, but it works. You need to pay for it penny by penny, dollar by dollar. The only way to get out of debt and to stay out of debt is to change your lifestyle. Consolidating loans, renegotiating your existing debt, debt consolidation and debt settlements can be a good start, but none of these techniques will keep you out of debt. There is no magical way to get out of debt.

0 kommentar(er)

0 kommentar(er)